- IOS List

- Posts

- Market Deep Dive: Denver

Market Deep Dive: Denver

Infill land appropriately zoned for outdoor storage is scarce, and redevelopment pressure continues to eliminate legacy IOS sites from the inventory.

IOS Market Deep Dive: Denver

Denver is widely viewed as one of the most supply-constrained IOS markets in the western United States. Infill land appropriately zoned for outdoor storage is scarce, and redevelopment pressure continues to eliminate legacy IOS sites from the inventory. Zoning standards vary across municipalities, adding complexity and risk for both tenants and investors attempting to secure or reposition IOS properties.

TLDR

Metro profile: Denver continues to function as a core logistics, contractor, and service hub for the Mountain West, supported by sustained in-migration, economic diversification, and expanding infrastructure.

IOS lease economics: IOS leases signed during 2024 and 2025 generally fall between $5,000 and $7,500 per acre per month, with an average near $6,500. Best-in-class infill sites can exceed $9,000 per acre per month.

Land values: IOS land pricing increased roughly 40 percent from 2023 to 2025, with recent sales typically ranging from $800,000 to more than $2 million per acre, averaging approximately $1.5 million.

Supply dynamics: Infill industrial land suitable for outdoor storage remains limited, while redevelopment pressure and tightening zoning standards continue to shrink available inventory.

Market outlook: Leasing velocity softened modestly, but vacancy remains compressed, renewals are occurring at market rates, and investor interest remains strong for well-located IOS assets.

Market Overview

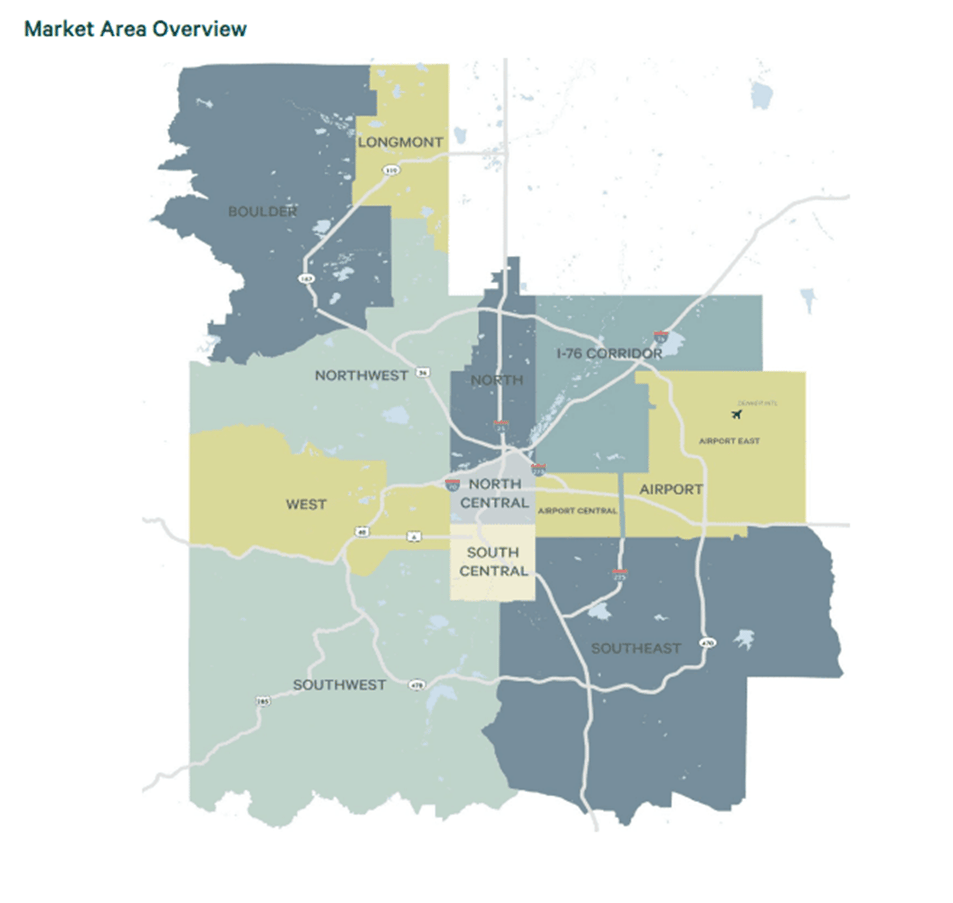

Denver remains one of the most important industrial and service-oriented markets in the Mountain West. The metro benefits from steady population growth, a broadening economic base, and a highly connected transportation network centered around I-25, I-70, I-76, E-470, and Denver International Airport. These fundamentals continue to attract contractors, fleet operators, equipment rental groups, and logistics users that require efficient regional coverage across Colorado and the broader Front Range.

Denver’s central location makes it a natural staging point for Mountain West distribution and service operations. Proximity to Denver International Airport, now among the busiest airports in the country, further strengthens the region’s role as a freight and logistics hub. Ongoing and planned airport expansions are expected to support long-term cargo and passenger growth, reinforcing demand for nearby industrial and IOS facilities.

Major public and private investment continues to shape the metro’s long-term trajectory. Recent completion of the 16th Street Mall reconstruction, the nearly $1 billion Vibrant Denver bond program, and discussions around large-scale redevelopment projects contribute to a sustained pipeline of construction and infrastructure-related activity. These initiatives, combined with consistent population growth over the past decade, support a deep labor pool and ongoing demand from service-based industrial users.

Industrial leasing activity slowed modestly in 2025, but fundamentals remain healthy. Market participants report that renewal activity continues to occur at prevailing market rates, signaling limited vacancy and stable pricing. While new leasing volume has cooled slightly, investor demand has remained resilient, driven by Denver’s supply constraints and high barriers to entry for new IOS development.

Tenant activity has shown recent signs of improvement, particularly among owner-users, heavy equipment operators, and maintenance-oriented businesses seeking long-term control of functional sites. Across the metro, zoning, permitting, and use approvals remain complex, making local expertise a critical component of executing IOS transactions.

IOS Market Fundamentals

Denver is widely viewed as one of the most supply-constrained IOS markets in the western United States. Infill land appropriately zoned for outdoor storage is scarce, and redevelopment pressure continues to eliminate legacy IOS sites from the inventory. Zoning standards vary across municipalities, adding complexity and risk for both tenants and investors attempting to secure or reposition IOS properties.

Despite slower leasing velocity over the past year, demand remains broad and durable. Transportation providers, utility and telecom contractors, environmental services firms, construction suppliers, and equipment rental companies all rely heavily on secure outdoor storage as part of daily operations. As a result, well-located sites with functional layouts and highway access continue to command premium pricing.

Source: Colorado DOT

Investor interest remains elevated. Even as tenant activity briefly plateaued, capital has remained focused on quality IOS opportunities, whether leased or vacant. The limited availability of buildings with yard space means that properly configured properties retain the ability to outperform broader industrial benchmarks when positioned correctly.

Denver’s industrial history also contributes to IOS durability. Legacy outdoor-oriented uses tied to oil, gas, mining, and construction have gradually evolved to support a broader mix of modern service and logistics users. While entitlement and permitting challenges persist, this scarcity has reinforced long-term value creation for existing, compliant sites.

Supply Constraints and Long Term Outlook

Limited new development, zoning friction, and redevelopment pressure continue to define the Denver IOS landscape. As the metro grows, competition for well-located industrial land is expected to intensify further, particularly for sites that offer immediate access to highways and population centers.

Source: CBRE

This environment places Denver alongside other maturing IOS markets such as Nashville, Phoenix, and Tampa. Even with short-term fluctuations in leasing activity, compressed vacancy, market-rate renewals, and renewed owner-user demand point to a sector driven by structural fundamentals rather than cyclical swings.

Bottom Line

Denver’s IOS market remains one of the tightest and most supply-constrained in the Mountain West. Limited entitled land, ongoing redevelopment pressure, and consistent demand from contractors, fleet operators, and service providers continue to support stable rents and strong pricing for functional IOS assets. For well-located sites, Denver offers scarcity-driven value backed by durable long-term demand.

Denver IOS Pros to Know

Broker | Firm | |

|---|---|---|

Mike Viehmann, SIOR | Newmark | |

Sam Slaton | Lincoln Property Co | |

Ryan Searle | Cushman & Wakefield | |

Sam Dragan | CBRE | |

Garrett Neustrom | Kenai Capital |

→ Try our resources for IOS pros: