- IOS List

- Posts

- Market Deep Dive: Nashville, TN

Market Deep Dive: Nashville, TN

The metro welcomed roughly 31,500 new residents in 2023 - about 86 people per day - bringing the total population to more than 2.15 million.

IOS Market Deep Dive: Nashville, TN

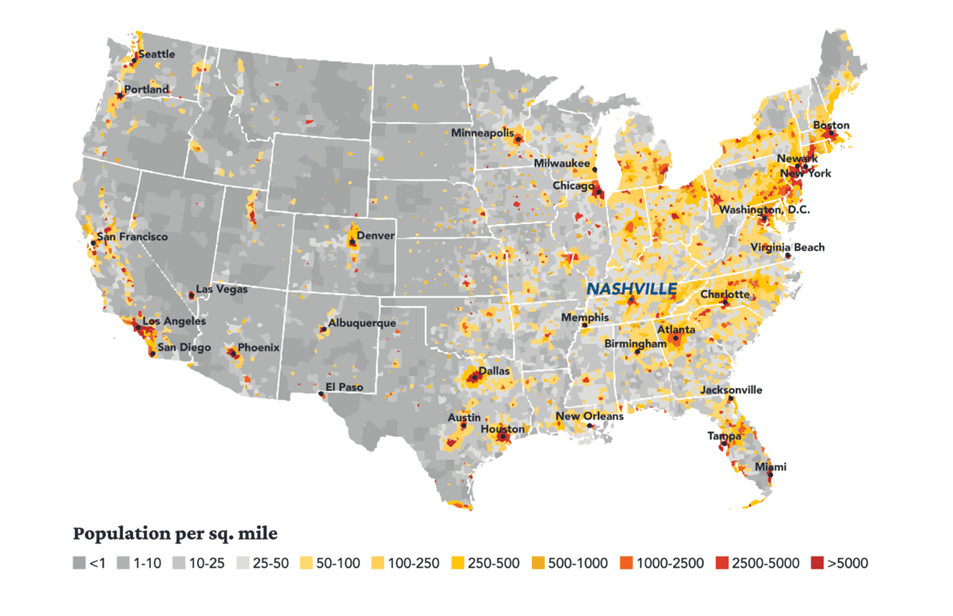

Nashville’s growth story remains intact. The metro welcomed roughly 31,500 new residents in 2023 - about 86 people per day - bringing the total population to more than 2.15 million. That influx continues to support job creation across transportation, manufacturing, professional services, and logistics. By mid-2025, unemployment hovered near 3%, placing Nashville among the tighter labor markets in the U.S.

TLDR

Population growth: Nashville added ~31,500 residents in 2023, pushing the metro past 2.15 million people.

Employment: Unemployment sits near 3%, signaling a tight labor market and steady business expansion.

Industrial vacancy: Roughly 4–5% as of mid-to-late 2025, reflecting constrained supply and solid absorption.

IOS lease economics: New IOS leases initiated between 2023–2025 average ~$8,000 per acre per month, with ~50% rent growth since 2023.

Land pricing: Average IOS land trades around $1.0M per acre in 2025, ranging from sub-$900K in outlying areas to $1.1M+ in prime locations.

Core corridors: Demand concentrates along I-24 and I-65, with La Vergne, Murfreesboro, Mt. Juliet, Lebanon, and Spring Hill capturing incremental growth.

Big picture: Limited land in Davidson County, improving infrastructure, and national connectivity continue to underpin long-term IOS demand.

Industrial Demand

Nashville’s growth story remains intact. The metro welcomed roughly 31,500 new residents in 2023—about 86 people per day—bringing the total population to more than 2.15 million. That influx continues to support job creation across transportation, manufacturing, professional services, and logistics. By mid-2025, unemployment hovered near 3%, placing Nashville among the tighter labor markets in the U.S.

On the industrial side, vacancy remains constrained at approximately 4–5% despite ongoing speculative development. That balance—new supply meeting steady absorption—has kept rents firm and pushed users to think more creatively about space, including outdoor storage solutions. Nashville’s location at the intersection of I-24, I-40, and I-65 allows operators to reach roughly three-quarters of the U.S. population within a single day’s drive, reinforcing the metro’s role as a regional and super-regional logistics hub.

IOS Overview: The Nashville Opportunity

Industrial outdoor storage fills operational gaps that traditional warehouses can’t: fleet parking, equipment laydown, trailer storage, and materials staging. In Nashville, IOS has quietly benefited from the same forces driving the broader industrial market—population growth, infrastructure spending, and supply-chain reconfiguration.

Recent IOS leases initiated between 2023 and 2025 average around $8,000 per acre per month, with rents up roughly 50% from 2023 levels. Transactions tend to be small-to-mid-scale, with most sites averaging three to four acres and skewing heavily toward single-tenant occupancy. This profile reflects a user base that values operational control, security, and proximity to major highways.

On the ownership side, 2025 pricing averages about $1.0 million per acre, though location matters. Well-located, improved sites can trade north of $1.1 million per acre, while parcels farther from core corridors may price below $900,000 per acre. That spread has created a clear “push-out” dynamic as users and investors balance cost against access.

Key Submarkets and Corridors

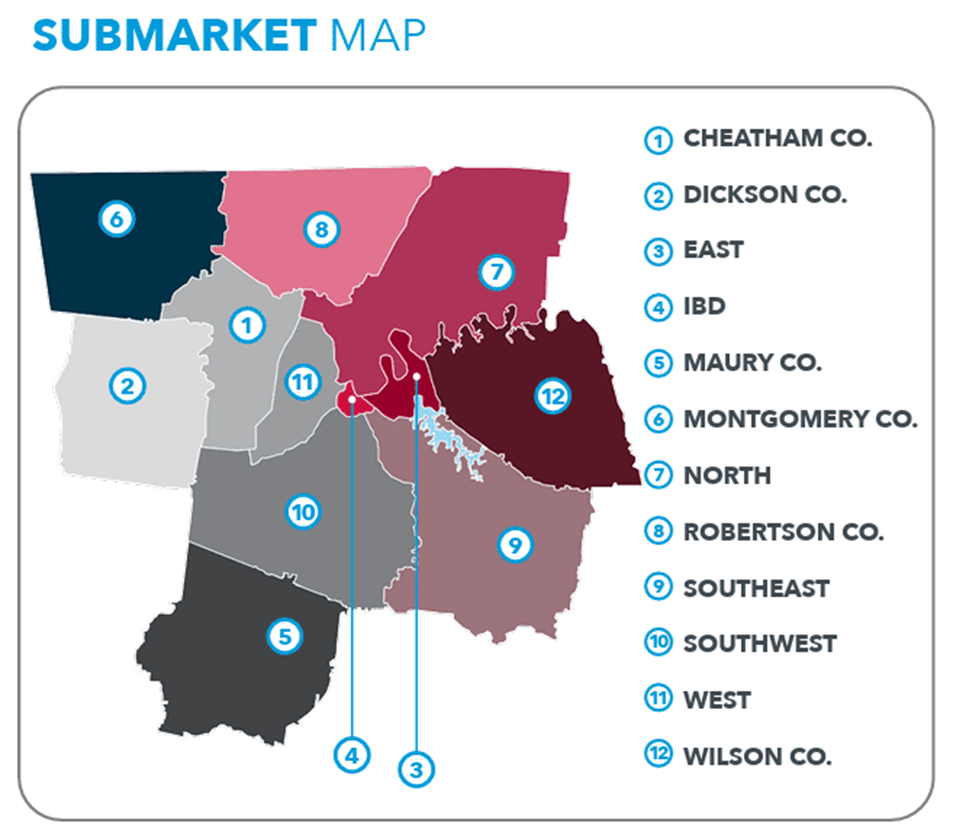

IOS activity clusters along Nashville’s primary transportation arteries:

I-24 / Southeast Corridor: La Vergne and Murfreesboro continue to see the highest concentration of IOS demand, driven by logistics fleets, contractors, and service providers that need fast interstate access.

Eastern Expansion: As Davidson County land tightens, demand is moving east into Mt. Juliet and Lebanon, where zoning is often more flexible and sites remain comparatively affordable.

I-65 South / Southwest: Spring Hill and areas farther south offer lower entry pricing while maintaining connectivity to regional trade routes.

This outward migration mirrors broader industrial patterns: limited infill supply in the urban core pushes growth to surrounding counties that can accommodate outdoor uses with fewer entitlement hurdles.

What’s Driving IOS Demand in Nashville

Several structural factors continue to support IOS fundamentals:

Transportation & Connectivity

Nashville’s interstate network, CSX rail access, growing air-cargo presence at BNA, and river access along the Cumberland River provide true multimodal optionality. For IOS users, that translates into efficient fleet movement and lower operating friction.

Tight Industrial Supply

With vacancy near 5% and limited developable land in Davidson County, IOS has become a practical release valve for users priced out of traditional warehouse space or unable to find suitable buildings.

Tenant Mix

Demand is anchored by logistics and transportation operators, construction and infrastructure contractors, automotive and defense suppliers, and regional service companies. These users tend to be established operators with long-term footprints, supporting durable tenancy.

Infrastructure Investment

Projects such as the I-24 SMART Corridor, I-65 widening, and new interchanges near La Vergne and Lebanon are improving freight flow and reducing congestion—incremental upgrades that disproportionately benefit outdoor-oriented users.

Capital Interest

Nashville continues to rank highly among U.S. metros for commercial real estate investment. Institutional and private capital remain active in IOS, attracted by steady cash flow, limited new supply, and long-term demographic tailwinds.

Bottom Line

Nashville offers a compelling IOS profile: strong population growth, low unemployment, tight industrial vacancy, and national connectivity. As land constraints in Davidson County intensify, IOS growth is shifting east and south along the interstate corridors, where zoning flexibility and infrastructure investment are unlocking new opportunities. For operators and investors alike, the market combines near-term cash-flow stability with long-term structural demand—hallmarks of a resilient IOS market in the Southeast.

Lee & Associates - Nashville IOS Pros

Broker | Firm | |

|---|---|---|

Brett Wallach | Lee & Associates | |

John Zeffery | Lee & Associates | |

Perry Wolcott, SIOR | Lee & Associates | |

Matthew Graves | Lee & Associates |

→ Try our resources for IOS pros: