- IOS List

- Posts

- Market Deep Dive: San Diego, CA

Market Deep Dive: San Diego, CA

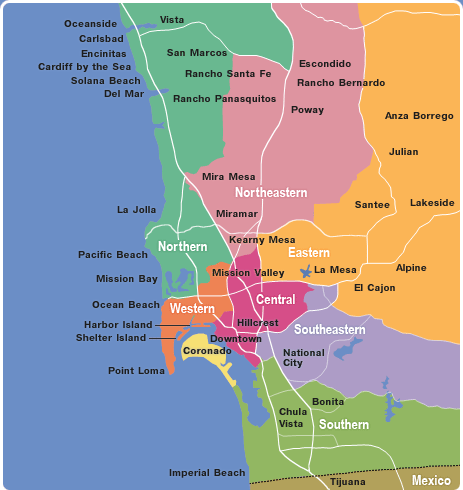

Submarkets such as Otay Mesa, Miramar, and Kearny Mesa continue to attract sustained industrial and IOS demand, supported by strong freeway connectivity.

Market Deep Dive: San Diego, CA

San Diego has quietly become one of the most supply-constrained and strategically important Industrial Outdoor Storage (IOS) markets on the West Coast. While the region doesn’t always receive the same attention as Los Angeles or the Inland Empire, fundamentals in San Diego tell a compelling story - particularly for yard-intensive users and long-term investors.

Our research team breaks down why IOS in San Diego continues to command premium pricing, how geography shapes the market, and where activity is most concentrated.

TLDR

Large, supply-constrained market: San Diego’s population exceeds 3.3M, supported by trade, defense, tech, and logistics employment. Industrial vacancy sits near 4%, among the tightest in California, with strongest demand in Otay Mesa, Miramar, and Kearny Mesa. Connectivity via I-5, I-8, SR-125, plus port and cross-border access, cements San Diego as a core IOS hub.

Attractive IOS economics: IOS leases signed 2023–2025 average $0.37/SF/month (~$16K per acre/month), with top submarkets like Miramar reaching $0.46/SF/month ($20K+ per acre/month). IOS land values generally range from $1M–$4M per acre, with relative value opportunities in Otay Mesa and Lakeside.

Strong fundamentals: Sub-4% vacancy reflects limited developable land and sustained absorption, particularly in Otay Mesa. Ongoing infrastructure investment—including the Otay Mesa East POE, SR-11 expansion, and airport modernization—is improving freight flow and binational trade efficiency.

Concentrated IOS inventory: Activity is focused in Otay Mesa, Chula Vista, Miramar, and National City, serving logistics, construction, and cross-border users. With scarce zoning and redevelopment pressure, IOS yards are increasingly viewed as critical logistics infrastructure, not interim land uses.

Active brokerage community: Market activity is being driven by experienced IOS specialists, with participation from JLL, Cushman & Wakefield, and Colliers. See below for names of the biggest players

Market Snapshot

San Diego County is home to more than 3.3 million residents and benefits from a diverse employment base anchored by defense, life sciences, logistics, manufacturing, and cross-border trade. Despite broader economic uncertainty, the region’s industrial vacancy remains among the tightest in California, hovering near the 4% range.

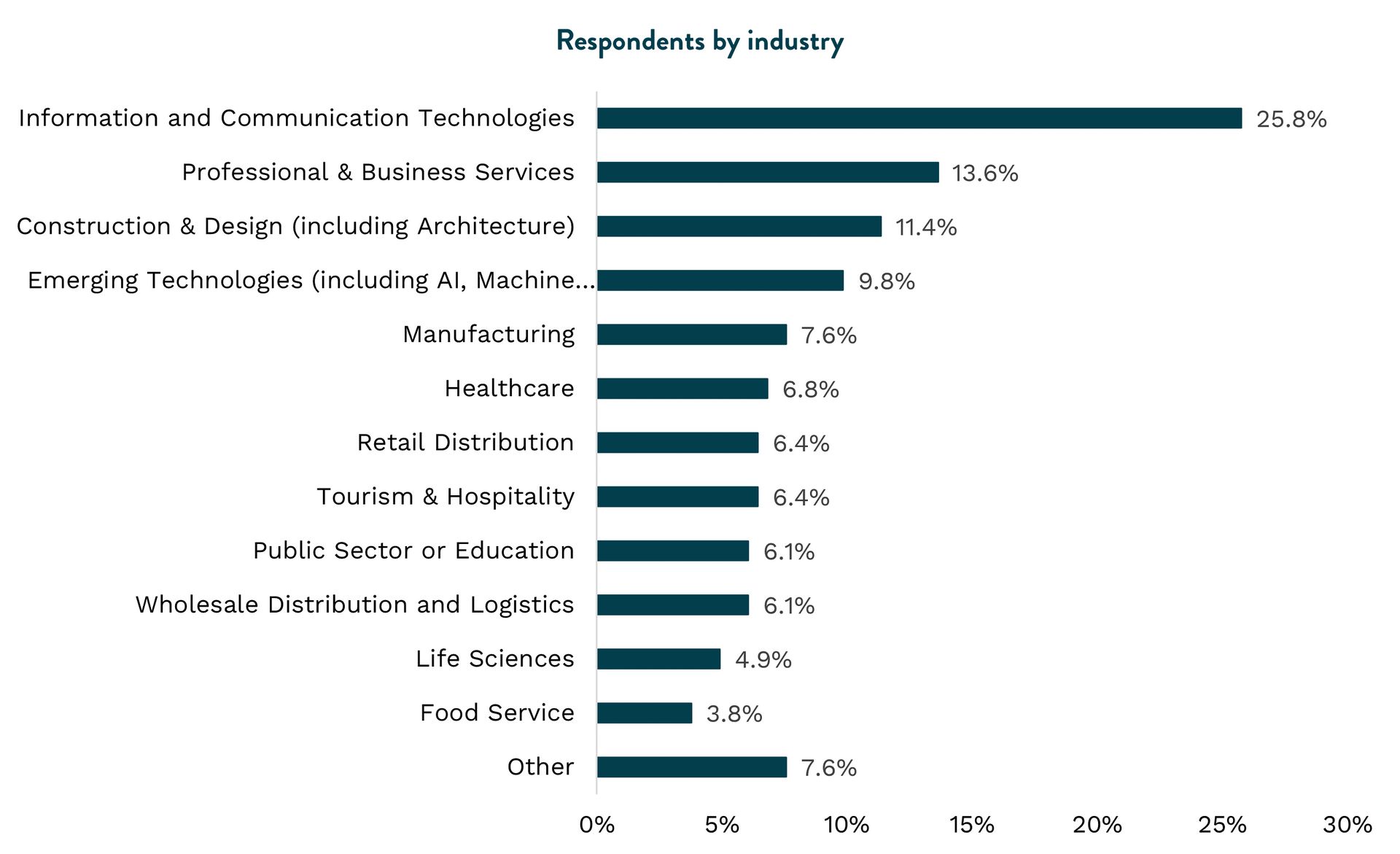

Biggest job needs in San Diego, 2025

Submarkets such as Otay Mesa, Miramar, and Kearny Mesa continue to attract sustained industrial and IOS demand, supported by strong freeway connectivity (I-5, I-8, and SR-125), proximity to the Port of San Diego, and direct access to Mexico. These structural advantages have helped position San Diego as a core logistics node rather than a secondary coastal market.

Why San Diego Matters in the IOS Ecosystem

San Diego sits at the heart of the “Cali-Baja” economic region, a binational manufacturing and distribution corridor stretching across Southern California and Baja California. The area plays an outsized role in the production of medical devices, aerospace components, semiconductors, and advanced electronics.

The San Ysidro Port of Entry—recognized as the busiest land border crossing in the Western Hemisphere—facilitates enormous daily freight and labor movement. Billions of dollars in goods circulate within the region annually, reinforcing demand for secure, well-located yard space on the U.S. side of the border.

This binational dynamic, combined with a highly constrained land supply, has created one of the most resilient industrial environments in the western United States.

IOS Market Conditions

Industrial Outdoor Storage has transitioned from a niche use to a critical piece of San Diego’s logistics infrastructure. Across leases signed between 2023 and 2025, IOS rents typically started around the mid-$0.30s per square foot per month, translating to roughly the mid-teens per acre on a monthly basis. In select infill locations—particularly Miramar—pricing has pushed meaningfully higher.

Ownership pricing reflects similar scarcity. In core submarkets, IOS-suitable land has traded anywhere from roughly $1 million to north of $4 million per acre, with more attainable pricing generally found in Otay Mesa and parts of East County.

Deal activity suggests that smaller, functional yards, often in the 2- to 3-acre range, remain the sweet spot for many users.

Who Is Leasing IOS in San Diego?

Tenant demand is led by a mix of equipment rental companies, construction firms, logistics operators, and cross-border distributors. Equipment rental users have accounted for a large share of recent leasing activity, typically favoring smaller yard footprints at more moderate pricing. Construction and infrastructure-related tenants, by contrast, have demonstrated a willingness to pay premium rents for better-located sites with strong ingress/egress and security features.

Other active users include trucking companies, manufacturers, utilities, and commercial service providers that rely on IOS yards for staging, fleet storage, and operational flexibility.

Structural Constraints Drive Value

Several forces continue to support IOS fundamentals in San Diego:

Geography:

The region is boxed in by the Pacific Ocean to the west, Mexico to the south, mountains to the east, and Camp Pendleton to the north. As a result, IOS sites exist only in specific pockets, limiting replacement supply.

Zoning Pressure:

Municipalities across the county have increasingly favored residential or mixed-use redevelopment, making IOS zoning more difficult to preserve or expand. This has reduced future supply even as demand remains intact.

Infrastructure Investment:

Major public projects—including the Otay Mesa East Port of Entry, the SR-11 corridor, and airport upgrades—are expected to further enhance freight efficiency and cross-border trade over the coming years.

Together, these dynamics have shifted IOS from a “transitional” land use to a mission-critical asset class.

Investment Outlook

Investor interest remains strong, though owner-users continue to set pricing benchmarks in many transactions. Institutional and private buyers alike are increasingly underwriting IOS as a standalone industrial subsector rather than an ancillary use.

While zoning reform and redevelopment pressures pose challenges, they also reinforce the long-term scarcity value of existing yards. As a result, many market participants view San Diego IOS as a durable, infrastructure-like investment supported by trade flows, population growth, and structural land constraints.

Bottom line:

San Diego’s IOS market is defined by limited supply, strategic geography, and essential logistics demand. As land availability continues to shrink and infrastructure investment expands, well-located outdoor storage sites are likely to remain among the most defensible industrial assets in Southern California.

Know the San Diego IOS Pros

Broker | Firm | |

|---|---|---|

Andy Irwin | JLL | |

Greg Lewis | JLL | |

Jackson Childers | JLL | |

Evan McDonald, SIOR | Colliers | |

Kurtis Blanchard | Colliers | |

Morrow Botros | Cushman & Wakefield |

→ Try our resources for IOS pros: